Homeowners Insurance in and around Tahlequah

Homeowners of Tahlequah, State Farm has you covered

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

- Cookson

- Fort Gibson

- Welling

- Park Hill

- Hulbert

- Peggs

- Locust Grove

- Bunch

- Tahlequah

- Cherokee County

- Muskogee County

- Adair County

- Mayes County

- Wagoner County

- Moody

- Sequoyah County

- Vian

- Gore

- Kanas

- Rose

With State Farm's Insurance, You Are Home

It's so good to be home, especially when your home is covered by State Farm. You never have to be uneasy about the unexpected with this great insurance.

Homeowners of Tahlequah, State Farm has you covered

Apply for homeowners insurance with State Farm

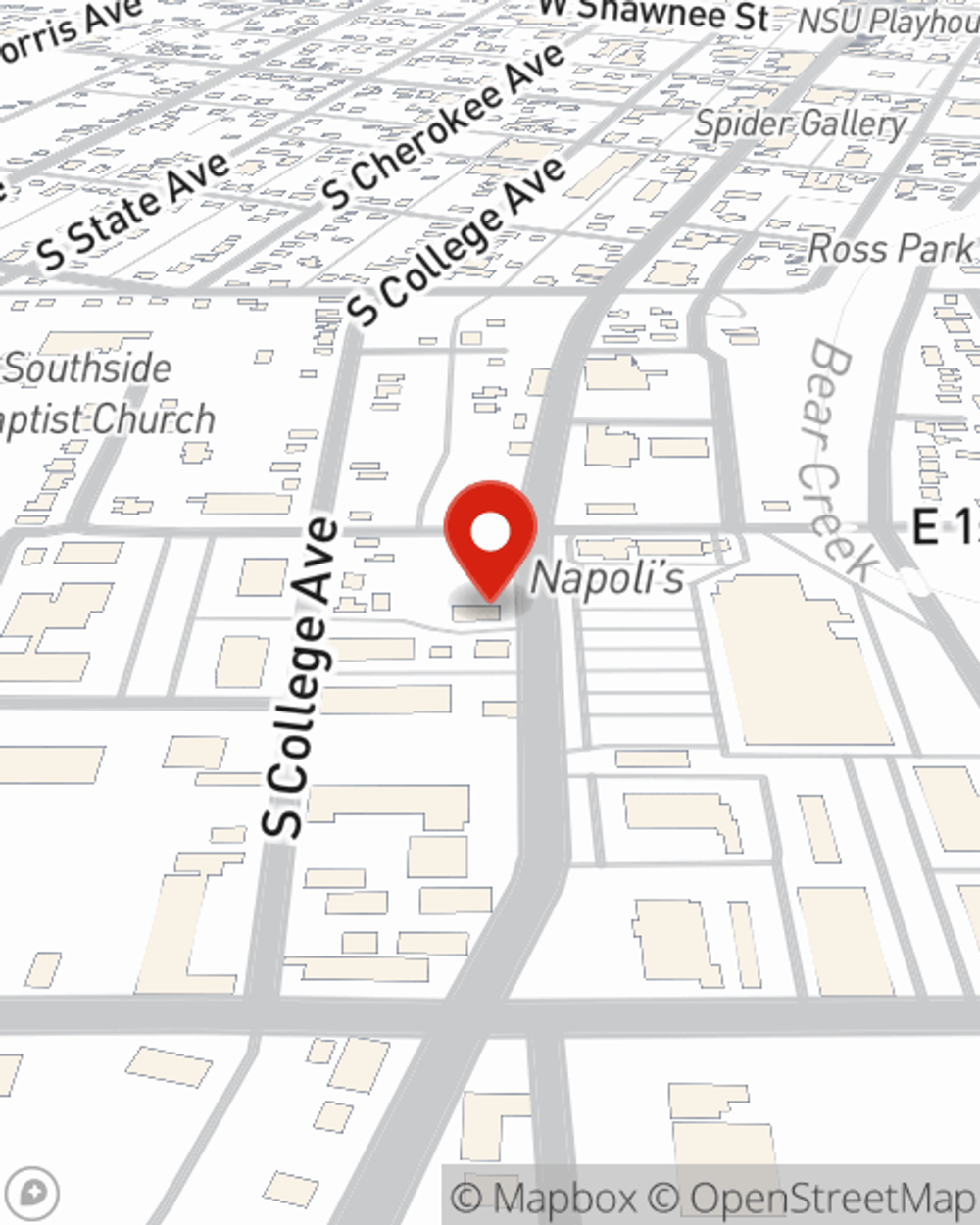

Agent Mark Hodson, At Your Service

Preparing for life's troubles is made easy with State Farm. Here you can personalize your policy or submit a claim with the help of agent Mark Hodson. Mark Hodson will make sure you get the personalized, excellent care that you and your home needs.

Ready for some help exploring your specific homeowners coverage options? Visit agent Mark Hodson's team for assistance today!

Have More Questions About Homeowners Insurance?

Call Mark at (918) 456-8881 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

What to do when your basement floods

What to do when your basement floods

Basement flooding isn't time for you to panic. Use these steps to figure who to call when a basement floods and what to do to protect your belongings and your home.

Mark Hodson

State Farm® Insurance AgentSimple Insights®

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

What to do when your basement floods

What to do when your basement floods

Basement flooding isn't time for you to panic. Use these steps to figure who to call when a basement floods and what to do to protect your belongings and your home.